Choosing the best bank in Kenya largely depends on your individual banking needs. While that’s true, certain general criteria are universally appreciated. For instance, accessibility is key to avoid long trips, good customer service is always valued, and reasonable fees are a big plus since those can really add up over time.

Here’s my personal ranking of 10 common banks in Kenya. This is based on my own experiences, consultations with others, and a lot of research. Note, this isn’t financial advice—just some friendly suggestions to help you in your search for the next best bank for you.

10. KWFT

KWFT isn’t your typical bank; it’s a microfinance bank. This means it’s designed to provide banking services to individuals who might struggle with traditional banking, like the elderly or the illiterate. But don’t think it’s just for women. Although it started with a focus on women, it serves everyone now. I used to run a business account with them, and the customer service was decent. However, they’ve got a bad rep on social media for being predatory with lending to old people.

Banking with them was okay until COVID hit. They stopped accepting cash deposits and forced us to use their paybill, which charged up to a ridiculous 10% fee. I mean, what bank says, “We don’t accept cash”? Is that even a bank anymore? So, I had to close my account.

9. Cooperative Bank

Cooperative Bank is one of the big three banks in Kenya, but honestly, I wouldn’t recommend it. There’s nothing particularly outstanding about it except for vehicle financing—they offer up to 100% financing, which you don’t see elsewhere. But for everyday use, their services are not intuitive. Their mobile banking is clunky, and the transaction fees are high, which is a deal-breaker if you transact a lot.

Their online services feel outdated, and customer experience, especially with loans, is terrible. They’re known to bully you if you’re even two days late on a loan. It’s so unprofessional compared to most banks on this list.

8. Family Bank

I opened a Family Bank account, but it didn’t meet my expectations. The transaction fees were too high for a business that transacts frequently, so I had to let it go.

Their portals and app felt clunky and unreliable sometimes. But overall, it’s an okay bank if you can overlook the charges.

They offer high-yield savings accounts with up to 12% interest, the highest among Kenyan banks, although SACCOs offer better rates.

7. Absa

Absa, formerly Barclays, was known for high charges and a minimum balance requirement in most accounts. After rebranding, the main issue users face is the constant system maintenance that seems endless and can happen anytime.

This makes Absa unreliable if you rely heavily on the app for transactions.

6. Equity Bank

Equity Bank is probably in the top two banks by the number of account holders. It’s everywhere, so if you travel a lot and need physical banking services, it’s a good choice. They’re known for the Wings to Fly program, a significant community initiative that other banks weren’t doing at the time, or at least not on their scale.

Equity’s direct integration with PayPal is a big plus for freelancers. That’s actually why I opened an Equity account. However, there have been numerous reports on social media about money disappearing from customer accounts.

I haven’t experienced this myself, but it’s a worrying trend. Their app can be clunky, and customer service at branches can be hit or miss. In over five years, I haven’t had any rude teller incidents, but many people have complained about this.

5. KCB

KCB is probably a decenta all rounder option for both business and personal accounts, there are system issues but not that common these days, in addition to mobile banking they have IBANK their version of internet banking that can be done on a web portal.

The app however can be a pain sometimes, and even re-installing needs a visit to the branch to activate it which isnt so efficient, customer service is mid to terrible as you might expect from any mainstream bank sunce they have many customers, you wont get the best personalized service

KCB is probably the best for loans and i can reccomend it,they are really patient with repayments and intrerest is reasonable, and it is the perfect bank for salaried individuals,

4. DTB

Good and underrated, never seen anyone really complain about DTB and people that have accounts with it that i know, swears by it i personally dont have an account but can commmend it, only practical for Nairobians as it doensnt have many branches in small towns outside the city

3. Stanbic

All i ever hear about Stanbic is compliments, so i can commend it, again it is limited in branches depending on where you live

2. Standard Chartered

StanChart is my primary bank account despite having accounts with multiple banks, this is so because this beank resonates with me in most aspects.

First thing first it is the best bank for introverts, you can do anything and everything on the app, ever since i opened the account 5 years ago, i have never stepped foot in a branch again, actually even opening a bank account does not need a branch visit, you can do it online and incase you are stuck there is a customer representative to guide you through every step.

Once you have the app it has alot, it is easy to even invest through the app and even buy government bonds and all that, it is secure never heard anyone saying money dissapeared from their StanChart account so there’s that peace of mind,

They dont charge you issuing of a debit card or even relacement incase you lose one, infact they even ship to your location via G4S and you dont have to visit the bank, this bank is really luxurious and i love it

However there are a few downsides but almost all these dont affect me so i dont mind, first of all there are limited ATMs especially if you are outside Nairobi, i dont need cash so that isnt an issue

The only thing that bothers me slightly is their bad banking app UI, good thing is it is reliable and works all the time, however it is ckunky and cluttured for first time users, so not very user friendly, plus the process of sending cash even to your M-PESA is a series of steps hich feel unneccesary, however once you get used to where to find everything it is a breeze

However those who receive salary via Standard Chartered report delays so if you want your money quick KCB is the best option.

1. I&M

Everyone who uses I&M swears by it, it is the only bank that offers zero bank to M-PESA transfers, and considering i spend over KSh 8,000 a month on those fees alone, switching to I&M is just common sense to get some pizza money

While that is the big deal with I&M, it is reported from users that issues are solved quickly and you get that friendly personal customer experience whenever you visit their branch, very diligent in their services

So, there you have it—my personal ranking of popular banks in Kenya. This is based on my own experiences and a lot of research to help you find the right bank for your needs.

Links

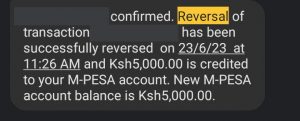

How to Reverse M-PESA Transactions

How to Increase Your Fuliza Limit in 2024