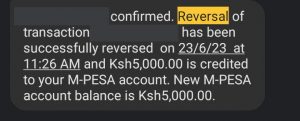

In today’s fast-paced world, mobile money services have become an integral part of our daily lives, revolutionizing the way we handle financial transactions: M-Pesa, one of the pioneers in this field, has consistently strived to provide innovative solutions to meet the evolving needs of its users. One such service offered by M-Pesa is Fuliza, an overdraft facility that allows users to complete transactions even when their M-Pesa balance is insufficient.

Understanding Fuliza

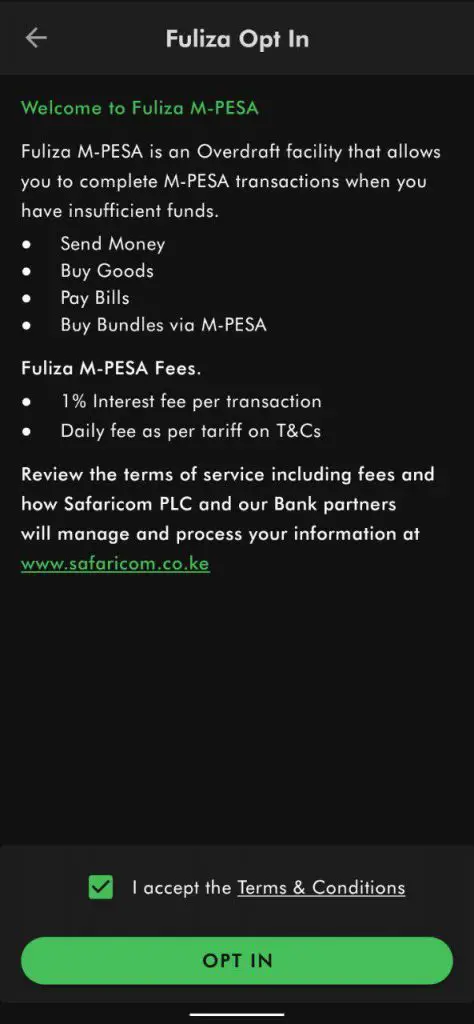

Before diving into how to increase your Fuliza limit, it’s essential to understand how the service works. Fuliza acts as a buffer when your M-Pesa balance is insufficient to complete a transaction. It allows you to borrow money to complete the transaction, subject to certain terms and conditions.

How to Check for a Bigger Limit Eligibility

Occasionally, your Fuliza limit might increase without your knowledge, as it doesn’t automatically update or notify users. To manually refresh and check for a potential increase in your limit, you can opt out of the Fuliza service and then opt back in. However, it’s essential to exercise caution as this action may either increase your limit or reset it to zero.

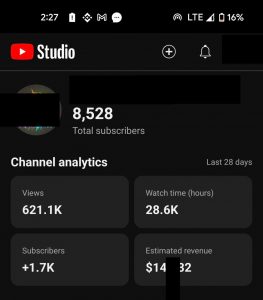

When Fuliza was initially launched, I had a limit of KSh 15,000. After a year, I opted out, and my limit reset to zero. Never used it for a year.

Subsequently, upon opting back in, my limit was set to KSh 4,500. After a few months of opting in and out, my limit eventually reached the current KSh 6,000.

To perform this check, simply dial *234# and follow the provided steps, or utilize the mySafaricom App. It’s worth noting that the M-PESA platform’s functionality for Fuliza opt-ins and opt-outs may be unreliable at the moment.

Steps to Increase Your Fuliza Limit

1. Usage History

M-Pesa monitors your transaction history to assess your eligibility for a higher Fuliza limit. Therefore, one of the primary ways to increase your Fuliza limit is to demonstrate responsible usage. This includes regular usage of M-Pesa services, timely repayments of Fuliza, and maintaining a good standing with M-Pesa.

2. Frequent Transactions

Engage in frequent transactions using M-Pesa services. The more transactions you make, the more data M-Pesa has to evaluate your creditworthiness. This demonstrates to M-Pesa that you are an active user who relies on their services, potentially leading to a higher Fuliza limit.

3. Maintain a Positive Balance

While Fuliza allows you to complete transactions even with a negative balance, consistently maintaining a positive balance in your M-Pesa account can positively impact your Fuliza limit. It indicates to M-Pesa that you manage your finances responsibly and reduces the need for frequent Fuliza usage.

4. Gradual Increase Requests

If you consistently demonstrate responsible usage and maintain a positive transaction history with M-Pesa, you can request a gradual increase in your Fuliza limit. Contact M-Pesa customer support or visit a Safaricom agent to inquire about the possibility of increasing your limit. Be prepared to provide information such as your usage history and reasons for requesting the increase.

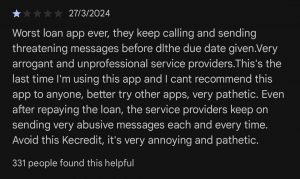

5. Credit Score Improvement

Improving your overall creditworthiness can indirectly impact your Fuliza limit. While M-Pesa may not use traditional credit scoring models, demonstrating financial responsibility in other areas of your life, such as loan repayments and bill payments, can reflect positively on your Fuliza eligibility.

Thoughts?

Still, the concept of Fuliza is not that straightforward, I have a lesser limit now despite transacting more than I did say 3 years ago when I had a bigger limit, some bigger celebrities have reported having a limit of just KSh 300 despite using MPESA a lot.