While instant mobile loans are popping up everywhere and might seem convenient, their dark side is much worse. In this post, I’ll talk about loan apps you should avoid and share my personal experiences with each one. The insane interest rates are just one problem; these apps can wreck your financial life if you’re not careful.

The funny thing is, that most of the “top-rated” apps on the Playstore or Appstore seem to be owned by the same company. You can tell because they all look the same and ask for the same info. They probably share your data across their services too. It’s no coincidence that one app offers you a loan while another one demands repayment before the due date, all happening at the same time. It’s pretty ridiculous.

While mainstream mobile loan services from banks and M-PESA charge minimal interest, they have low limits, which becomes an issue if you need a substantial amount, say over 10,000 KES. This is where shady loan apps gain an advantage.

For example, M-PESA’s M-Shwari service requires you to save with them before qualifying for a loan. In contrast, other loan apps require nothing more than your details and reference contacts. Just fill out a form, and you can borrow up to 25,000 KES initially, with potential increases if you repay on time. Meanwhile, FULIZA, another Safaricom product, acts more like an overdraft service than a traditional loan.

Despite a daily charge, FULIZA is much cheaper if you have a limit. The maximum daily fee is 30 KES, so borrowing 10,000 KES for a month costs less than 1,000 KES.

These shady loan apps not only charge exorbitant rates but also have a repayment period of just seven days. If you wish to extend, you will have to pay double the interest. They even start calling three days before the due date, insisting you pay immediately to double your next loan limit. Paying earlier doesn’t reduce the interest; it’s just a selfish tactic.

The worst part is the unprofessional, defensive SMS spam they send, often landing in spam folders since most people block these numbers. But they use multiple numbers, so the messages keep coming.

I understand this is a risky business with many defaulters, which is why they charge high interest to cover the losses. They use intimidation tactics, like accessing your contact list to call random people, to embarrass defaulters into paying. They thrive on people’s desperation, as those taking these loans often have no other options.

Below are the apps you should avoid. There are many, but here are the ones I’ve had experiences with.

1. Creditmoja

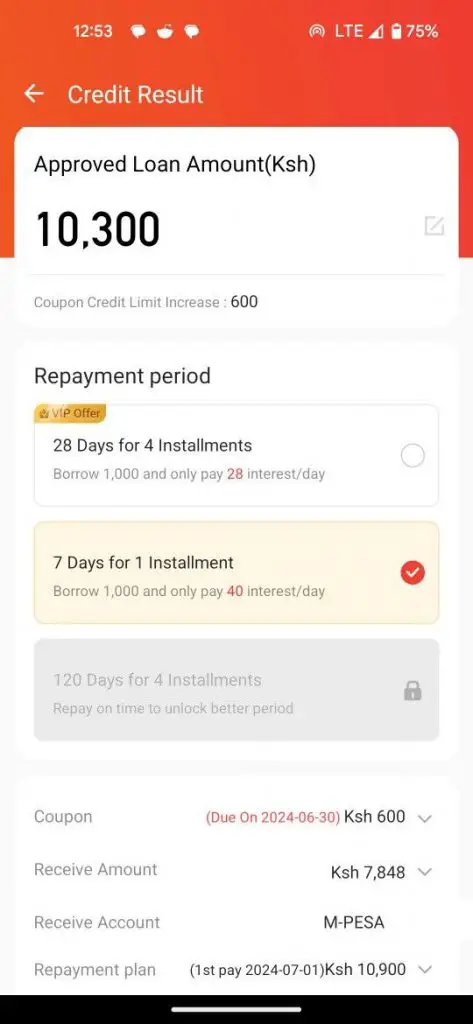

As mentioned, these apps all use the same psychological tricks. First, the amount you borrow isn’t what you receive. For example, if you request 10,300 KES, you’ll actually get 7,848 KES. They’ve already deducted 2,452 KES.

But you still have to pay back 10,900 KES. See the trick? It seems like you’re borrowing 10,300 KES and repaying 10,900 KES within a week, which sounds reasonable. But in reality, you’re paying 3,052 KES in interest for just receiving 7,848 KES! Honestly speaking someone who is borrowing 10,000 cannot comfortably afford to justify that amount of interest within a week, unless it is a life-and-death matter or give in out of desperation.

I don’t even know how this is legal, but somehow you agreed to the terms and conditions. So, essentially, they charge 39% interest per week! In comparison, banks charge 13% per annum. These apps charge three times that, and it’s weekly! See the difference now?

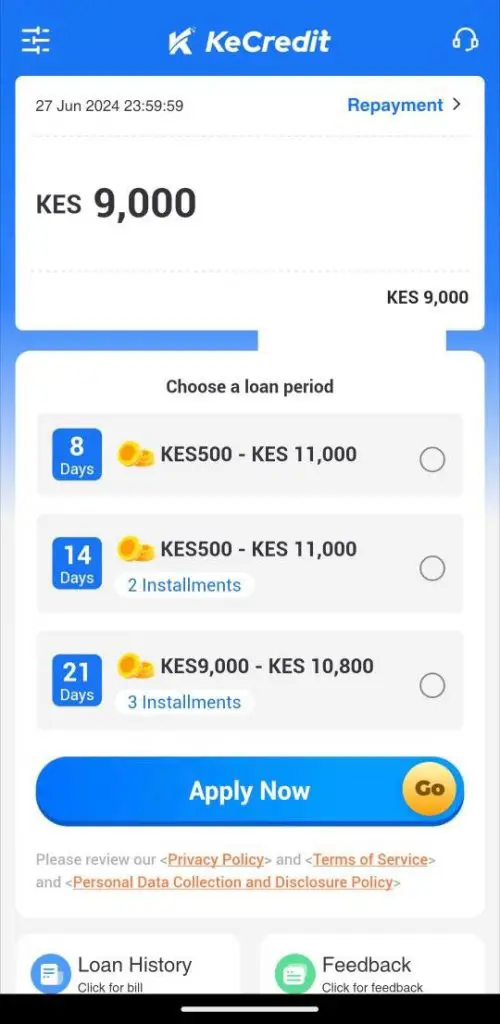

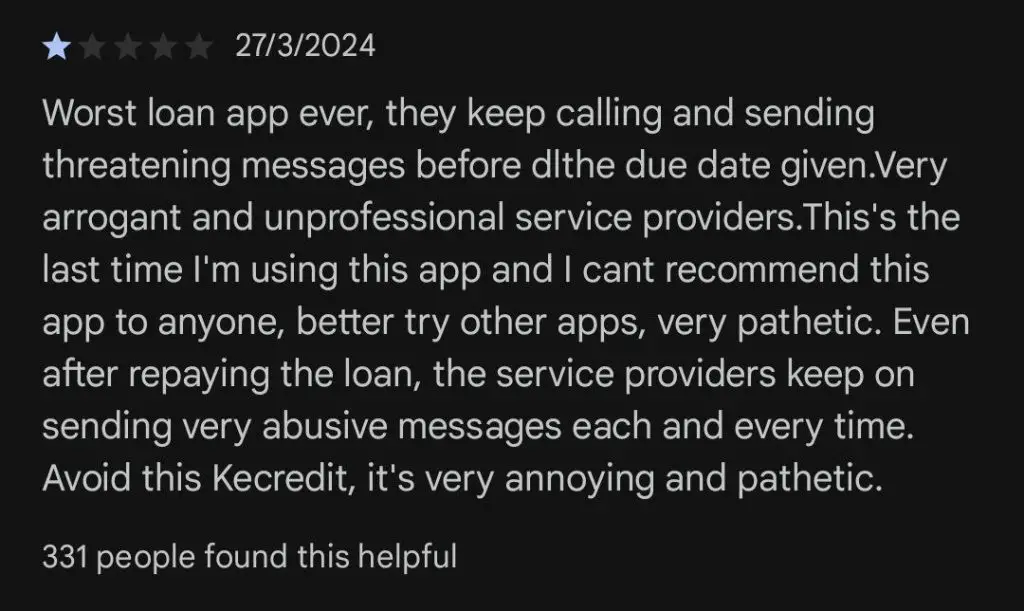

2. KeCredit

As said before all these apps operate the same KeCredit has a different UI from Creditmoja, I think they just keep rebranding to different “new apps” once they get backlash from bad reviews, most reviews you will see are all praising, and 5-star making you wonder if they are authentic, to begin with.

Well, these apps offer instant loans when you can’t get money elsewhere, and they dispatch it in just 5 minutes which is very good, yes interest robbery but you are desperate remember, the worst part however is the harassment before the due date, if you are charging me interest for 7 days then why would you harass people to pay you earlier? Citing that loans are normally paid early, even tho it is not stated so anywhere when applying.

3. TruPesa

TruPesa looks the same as Ke Credit but surprisingly they never call to harass you before your loan is due, yes they will send those stupid SMSs that will end up in spam anyway, but so far this one is the better of the three here if you have no other option, interest is still high but at least they don’t harass you with phone calls every 5 minutes 2 days BEFORE THE DUE DATE

Best Loan Apps Recommendations in Kenya

I will make a different article on this but essentially apps like Tala, Branch, Zenka, and LendPlus are what you should consider.

Yes, the starting limit is not as high as these other apps, here you get a limit starting at 3,000 KES and you are charged an interest of just 600 to repay within a week, and they won’t bother you before the due date, so yes consider those 3 if you need a loan and avoid everything else!

Also Read: 10 Popular Banks in Kenya Ranked Worst to Best

Also Read: How to Increase Your Fuliza Limit in 2024